How to use Stoploss-limit(SL) order like a Stoploss-Market(SLM) order?

If you want to use a stop-loss limit (SL) order like a stop-loss market (SLM) order, you need to set the limit price at the stop-loss level. In short, the main difference between a stop-loss limit order and stop-loss market order is in how the order is executed. A stop-loss limit order is executed at or better than the limit price that you set. A stop-loss market order is executed as market order, meaning that it will be executed at the best available price, which could be higher or lower than the stop-loss price you specified.

Usually, these trades are seen when the market depth is shallow. Due to this liquidity will be low. This leads to freak trades when the larger market order interfuse to your trade. A limit order offers the benefit of price execution at a certain level, avoiding a freak trade, but does not provide a guarantee of order fill, whereas placing a market order bears the inherent risk of potential losses due to a freak trade. It is possible to combine the advantages of both order types, enabling the price protection provided by a limit order while still taking advantage of the order fill guarantee generally associated with a market order.

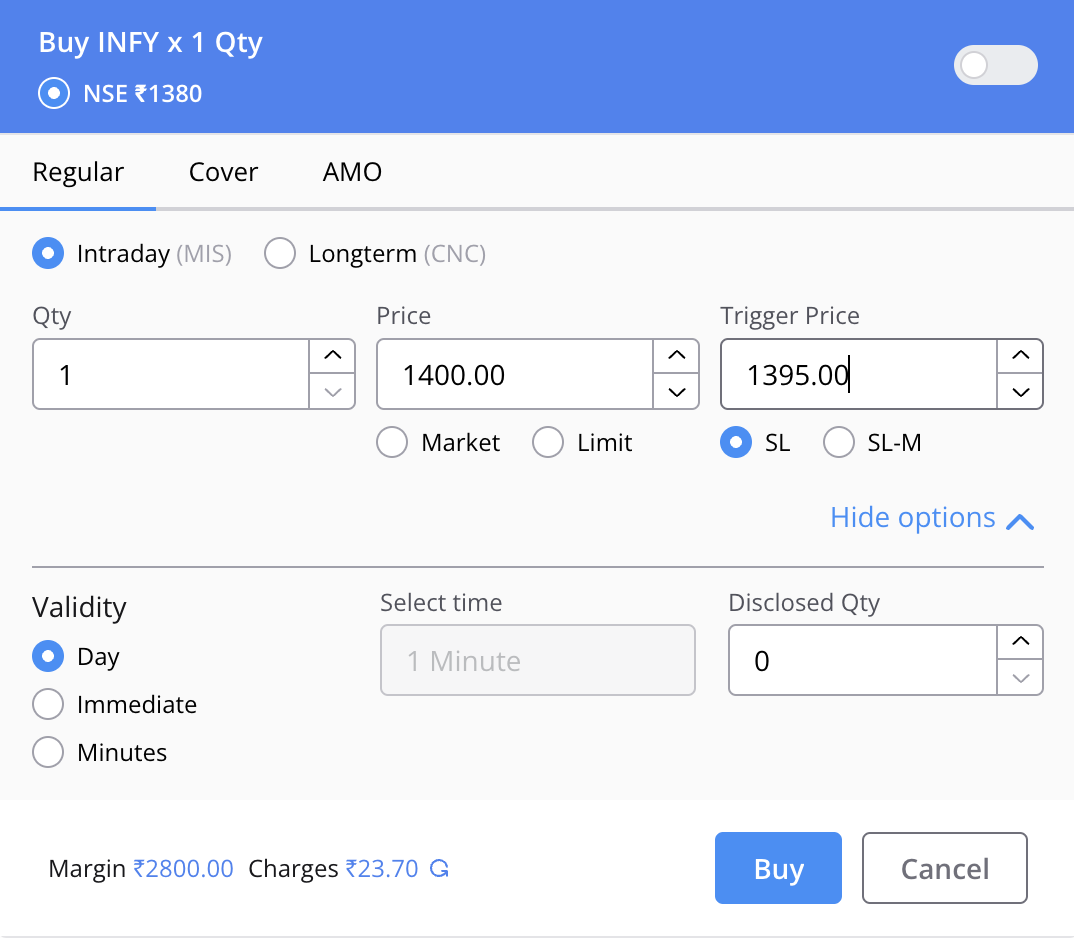

Buy Side Scenario:

Suppose you have a short future position in Infosys and Infosys is trading now at the price of 1380. So squaring off the position, you have to place a buy order.

Now you create a buy SL order with- Limit Price = 1400 Trigger Price = 1395

As you have created a buy order with a higher limit price and the current trading price of the stock is lower than your limit price So, the order will execute as market order and the order will execute immediately. Because of the quantity you wish to buy, will be bought at the higher market price of Rs 1400.

The SL price at Rs. 1400 protects against a freak trade in the case that another larger market order interfuse with your order, reducing the risk of unforeseen price changes. Similar to when SL sell limit orders behave as SL market orders when they are set with a price below the going market rate.

The limit price at Rs. 1600 protects against a freak trade in the case that another larger market order interfuse with your order, reducing the risk of unforeseen price changes. Similar to when SL sell limit orders behave as SL market orders when they are set with a price below the going market rate.

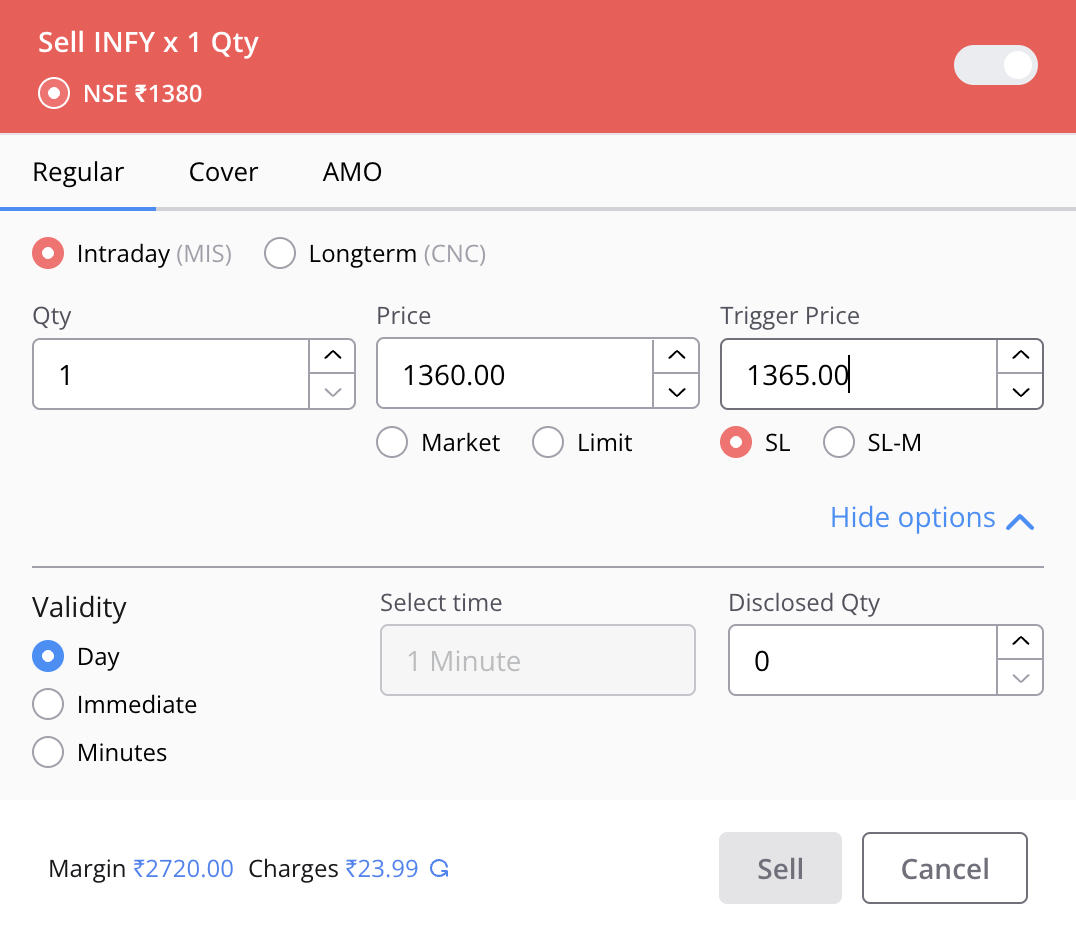

Sell Side Scenario:

Suppose you have a long position in Infosys and Infosys is trading now at the price of 1380. So squaring off the position, you have to place a sell order.

Now you create a sell SL order with- Limit Price = 1360 Trigger Price = 1365

As you have created a sell order with a lower limit price and the current trading price of the stock is higher than your limit price So, the order will execute as market order and the order will execute immediately. Because of the quantity you wish to sell, will be sold at the lower market price of Rs 1360.

This limitation protects against negative price swings and prevents the sell price from sharply falling.

Click here to learn about limit order as market order.